Throughout the year, we continued the strategic repositioning of this division and made important changes to better align our service offering with the changing needs and preferences of our Canadian clients. In January, we appointed Stuart Raftus as President of Canaccord Genuity Wealth Management in Canada. With more than 28 years of experience in the securities business, Stuart’s proven expertise in enhancing operational environments and exceptional commitment to client service make him well suited to lead this division.

We have focused in markets where we have developed a significant presence and those that show prospects for market share growth. We have implemented training programs to ensure our wealth management professionals have the tools and expertise to provide holistic wealth management advice to clients with diverse financial planning needs. And importantly, we have made operational and administrative adjustments which will meaningfully impact our margins. These steps, in combination with a more robust Canadian market, are expected to help this division become a greater contributor to the overall franchise.

We are committed to growing our assets under management and advisory fees and, with our stronger client service philosophy, gaining new client relationships and increasing share-of-wallet from our existing clients.

22.2%

DECREASE

IN ANNUAL EXPENSES

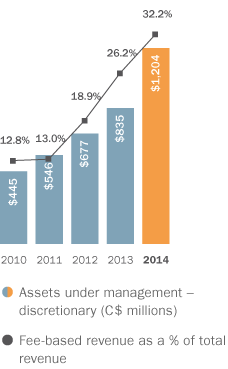

ASSETS UNDER MANAGEMENT – DISCRETIONARY, AND FEE-BASED REVENUE AS % OF TOTAL REVENUE

Assets under Management – Discretionary, and fee-based revenue as % of total revenue

| Year |

Assets under management - discretionary (C$ millions) |

Fee-based revenue as a % of total revenue |

| 2010 |

445 |

12.8 |

| 2011 |

546 |

13.0 |

| 2012 |

677 |

18.9 |

| 2013 |

835 |

26.2 |

| 2014 |

1,204 |

32.2 |