Canaccord Genuity delivers exceptional value to clients through our unique understanding of global issues and opportunities and our diverse institutional distribution capability. Our integrated full-service platform and highly ranked global research team allow for extensive access to investors around the world. With experienced professionals located in 11 countries worldwide and deep institutional relationships, we take pride in having the broadest account coverage of any mid-market bank.

Our unparalleled service offering, in addition to our growing cross-border capabilities, has become a key differentiator of our business. As we continue to focus on integrating our global capital markets business, we expect the momentum built last year to continue through fiscal 2015. That is, Canaccord Genuity should continue to enjoy strong contributions from its various geographical platforms.

COMPREHENSIVE AND DIVERSIFIED SECTOR COVERAGE

Canaccord Genuity’s global team of investment banking, equity research, and sales and trading professionals are dedicated to providing clients with actionable ideas and opportunities in 18 key sectors of the global economy.

Aerospace & Defence

Agriculture

CleanTech & Sustainability

Consumer & Retail

Energy

Financials

Healthcare & Life Sciences

Infrastructure

Leisure

Media & Telecommunications

Metals & Mining

Paper & Forestry Products

Real Estate & Hospitality

Support Services

Technology

Transportation & Industrials

Investment Companies

Private Equity

GLOBAL ADVISORY CAPABILITY

We have talented professionals forming a unified multilingual team operating from our offices in Canada, the US, the UK, Ireland, France, Germany, China and Australia.

Our worldwide M&A capabilities link our clients to opportunities on a global scale.

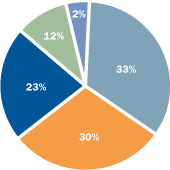

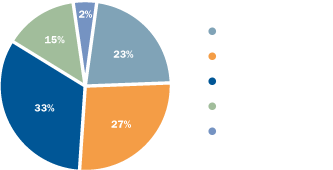

INVESTMENT BANKING TRANSACTIONS AND REVENUE BY SECTOR DURING FISCAL 2014

| Sector |

As a % of investment banking transactions |

As a % of investment banking revenue |

| Technology |

13.8% |

26.4% |

| Healthcare & Life Sciences |

12.9% |

15.4% |

| Energy |

13.5% |

11.9% |

| Metals & Mining |

9.0% |

10.5% |

| Real Estate & Hospitality |

9.6% |

7.8% |

| Investment Companies |

0.8% |

4.9% |

| Financials |

5.9% |

4.6% |

| Consumer & Retail |

2.8% |

4.5% |

| CleanTech & Sustainability |

2.2% |

3.9% |

| Media & Telecommunications |

0.6% |

2.6% |

| Structured Products |

21.9% |

0.7% |

| Other |

7.0% |

6.8% |

| Total |

100.0% |

100.0% |

ABILITY TO LIST COMPANIES IN SIX COUNTRIES ON 10 EXCHANGES

1,000

COMPANIES

OUR AWARD-WINNING EQUITY RESEARCH TEAM PROVIDES IDEA-DRIVEN COVERAGE OF MORE THAN 1,000 COMPANIES

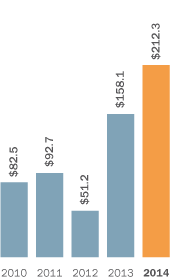

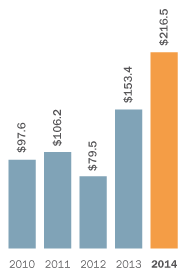

29.4%

GROWTH

IN M&A AND ADVISORY REVENUES SINCE COLLINS STEWART HAWKPOINT ACQUISITION

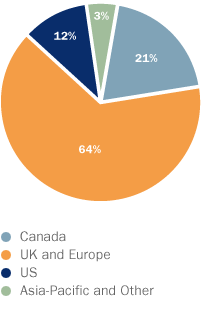

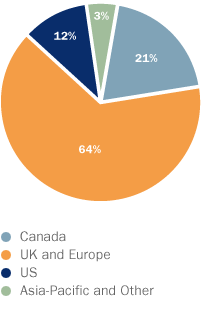

GEOGRAPHIC BREAKDOWN OF GLOBAL M&A AND ADVISORY REVENUE DURING FISCAL 2014

Geographic Breakdown of Global M&A and Advisory Revenue During Fiscal 2014

(%)

| Country |

Geographic Breakdown of Global M&A and Advisory Revenue During Fiscal 2014 (%) |

| Canada |

21 |

| UK and Europe |

64 |

| US |

12 |

| Asia-Pacific and Other |

3 |

13.8%

INCREASE

in annual revenue