- CANACCORD AT A GLANCE

- letter to shareholders

- canaccord genuity

- wealth management

- the evolution

of our business - corporate values

- md&a and financials

In the UK and Europe, Canaccord Genuity Wealth Management (CGWM) had a very successful year and exceeded its stated goal of reaching £10 billion of assets under management through a combination of acquisition activity and organic growth. In this highly competitive market, CGWM continues to win awards for the quality of its services and the performance of its portfolios.

Canaccord Genuity Wealth Management generated $91.8 million in revenue during fiscal 2013, and earned $13.3 million in net income before tax, excluding acquisition-related expenses. This is the 15th consecutive year this business has been meaningfully profitable, and its recent growth of assets under administration demonstrates the momentum we continue to build in the UK and offshore wealth management markets.

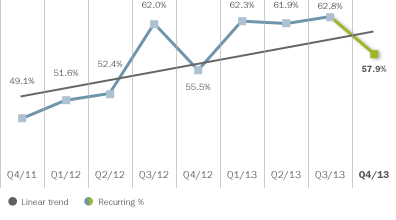

Fee-based revenue grew to 61% during fiscal 2013 – an increase of six percentage points from 55% last year. Fee-based activities produce a steady, recurring revenue stream and are considered to be an important contributor to this business’ performance. Assets under management increased to $15.9 billion at the end of the fiscal year, due in part to the acquisition of Eden Financial’s wealth management business in October 2012. CGWM gained 35 professionals through this expansion, and £835 million of client assets on behalf of 2,500 high-net worth private and family accounts. The integration of this business was completed during the year. Today all CGWM clients benefit from access to the same financial solutions, support and personalized approach to wealth management.

We believe opportunities to further strengthen our UK wealth management platform will occur over the next several years. Prospects to acquire new teams of investment professionals are expected as regulatory changes implemented in the UK prompt industry consolidation.

Canaccord Genuity Wealth Management provides highly tailored wealth management, stockbroking and portfolio management services to individual investors, institutions and charities from six offices, located in London, the Channel Islands, the Isle of Man and Geneva.

RECENT AWARDS

Portfolio Management

Defaqto 5 Star Rating – Discretionary Portfolio Management Service 2013

Incisive Media Gold Standard – Discretionary Portfolio Management – 2012 Winner

Money Marketing Financial Services Awards – Best Discretionary Adviser – 2012 Winner

Stockbroking

City of London Wealth Management Awards – Best Advisory Service – 2013 Winner

City of London Wealth Management Awards – Best Advisory Service – 2012 Winner

Wealth Management

WealthBriefing Europe Awards 2013 – Best M&A Deal – 2013 Winner

Finance Monthly Deal Maker of the Year Awards – 2012 Winner

Citywealth Offshore Awards – UK Offshore Investment Manager of the Year – 2013 Runner up