- CANACCORD AT A GLANCE

- letter to shareholders

- canaccord genuity

- wealth management

- the evolution

of our business - corporate values

- md&a and financials

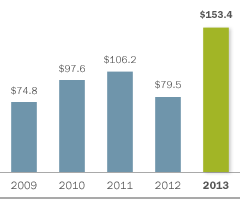

In the past year, we have significantly strengthened our US market position, refocused our investment banking practice towards lead mandates and gained important operating efficiencies through continued efforts to lower operating expenses. Canaccord Genuity’s expanded US platform began to demonstrate its potential in fiscal 2013 with record revenue, due largely to trading market share gains and our growing US advisory practice.

In the United States, Canaccord Genuity generated $153.4 million in revenue during fiscal 2013 – a 93% increase compared to the previous year. The much improved capital markets performance of our US business was due largely to the expansion initiatives Canaccord undertook last year to grow the scale of our US operations. A focused effort on better aligning the services of this business with our global capabilities helped the investment banking practice secure more lead mandates throughout the year, and delivered the support and global reach necessary to grow advisory revenue. During fiscal 2013, revenue from advisory activities tripled from the previous year, to $21.3 million.

Canaccord Genuity’s coverage of the US Healthcare and Life Sciences, Technology, and CleanTech and Sustainability sectors is particularly strong. 91% of the capital raising transactions led or co-led by Canaccord Genuity in the US during the year and 82% of investment banking revenues earned during fiscal 2013 were from these sectors.

Our sales and trading capabilities were also bolstered materially through the acquisition of CSHP, substantially growing our institutional market share and revenue from trading activities throughout fiscal 2013. The addition of the International Equities Group in March 2012, who specialize in American Depositary Receipts (ADR) and electronic trading, also contributed significantly to principal trading revenue.

A continued emphasis on improving operating efficiency in the US began to show progress in the last six months of the fiscal year, with expense ratios improving materially through efforts to consolidate real estate, re-negotiate supplier contracts and better align staffing levels. A focus on improving operating margins in this business will continue to be a priority in the year ahead.

Canaccord Genuity’s expanded US platform generated $40.1 million of revenue through principal trading activities – due largely to the Company’s International Equities Group (IEG).

200%

increase in advisory revenue compared

to the previous year

28.5%

of Canaccord Genuity’s global revenue

was generated in the US

250+

employees