- CANACCORD AT A GLANCE

- letter to shareholders

- canaccord genuity

- wealth management

- the evolution

of our business - corporate values

- md&a and financials

Canaccord Genuity significantly strengthened its market position in the UK and Europe in the last year, due largely to the expansion activities we undertook at the end of fiscal 2012. Today, Canaccord Genuity has the third most corporate clients in the UK of any investment bank and is capturing more trading market share than ever before.

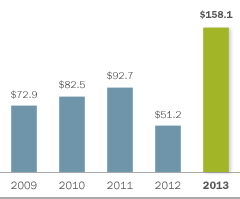

The acquisition of Collins Stewart Hawkpoint in March 2012 bolstered the capabilities of Canaccord Genuity in the UK and Europe immensely, and this was demonstrated in our fiscal 2013 results. The division earned $158.1 million in revenue in the region, more than doubling the revenue generated by our UK operations in the previous year.

A key focus for management during fiscal 2013 was further integrating aspects of our investment banking practice in this important region. By unifying our corporate broking and advisory teams into one combined full-service investment banking practice, our corporate clients now benefit from a dedicated, full-service investment banking team that caters to the needs of companies in all of their growth and corporate development activities.

Canaccord Genuity’s sales and trading team in the UK has also significantly strengthened its market position by better aligning our securities business with changing client demands and the Company’s global institutional coverage. Trading and commission levels steadily improved throughout the year, despite overall market volume declines in the region, which represents a meaningful gain in market share.

We expect additional cost and revenue synergies can still be obtained from the acquisition we completed last year, and have made strong progress in capturing these for shareholders. A continued emphasis on improving operating efficiency in the UK and Europe was evident during fiscal 2013, with projects focused on removing excess capacity from the business, lowering supplier costs and extracting further revenue synergies from the expanded UK platform.

Canaccord Genuity was the most active investment bank in the UK for number of transactions led or co-led during calendar 2012.

ALL UK EQUITIES: BOOKRUNNERS

(Calendar 2012)

| Rank | Managing bank or group | No. of issues |

Total (US$ millions) |

Share (% value) |

|---|---|---|---|---|

| 1 | Canaccord Genuity | 14 | $ 552.34 | 3.4 |

| 2 | JP Morgan | 13 | 2,856.86 | 17.4 |

| 3 | UBS | 8 | 1,391.94 | 8.5 |

| 4 | Investec | 7 | 1,268.53 | 7.7 |

| 5 | Oriel Securities | 7 | 501.34 | 3.1 |

| 6 | Barclays | 6 | 636.00 | 3.9 |

| 7 | Bank of America Merrill Lynch | 4 | 2,191.03 | 13.4 |

| 8 | Citigroup | 4 | 1,431.26 | 8.7 |

| 9 | Goldman Sachs | 4 | 615.93 | 3.8 |

| 10 | Morgan Stanley | 3 | 1,026.56 | 6.3 |

| Total | 193 | 16,376 |

Source: Thomson Reuters. Bookrunners: 1/1/2012–31/12/2012. Includes all domestic and international deals and rights issues. SDC code C4c1r.