- CANACCORD AT A GLANCE

- letter to shareholders

- canaccord genuity

- wealth management

- the evolution

of our business - corporate values

- md&a and financials

Financial Highlights

Selected financial information(1)(2) |

For the years ended March 31 | |||||||

|---|---|---|---|---|---|---|---|---|

| (C$ thousands, except per share and % amounts) | 2013 | 2012 | 2013/2012 change | |||||

| Canaccord Financial Inc. (CFI) | ||||||||

| Revenue | ||||||||

| Commissions and fees | $ | 353,125 | $ | 252,877 | $ | 100,248 | 39.6% | |

| Investment banking | 145,772 | 175,225 | (29,453) | (16.8)% | ||||

| Advisory fees | 179,690 | 107,370 | 72,320 | 67.4% | ||||

| Principal trading | 66,406 | 10,647 | 55,759 | n.m. | ||||

| Interest | 29,199 | 31,799 | (2,600) | (8.2)% | ||||

| Other | 22,930 | 26,946 | (4,016) | (14.9)% | ||||

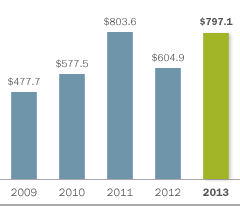

| Total revenue | 797,122 | 604,864 | 192,258 | 31.8% | ||||

| Expenses | ||||||||

| Incentive compensation | $ | 406,724 | $ | 304,908 | $ | 101,816 | 33.4% | |

| Salaries and benefits | 88,522 | 63,924 | 24,598 | 38.5% | ||||

| Other overhead expenses(3) | 292,242 | 200,842 | 91,400 | 45.5% | ||||

| Restructuring costs(4) | 31,617 | 35,253 | (3,636) | (10.3)% | ||||

| Acquisition-related costs | 1,719 | 16,056 | (14,337) | (89.3)% | ||||

| Total expenses | 820,824 | 620,983 | 199,841 | 32.2% | ||||

| Loss before income taxes | (23,702) | (16,119) | (7,583) | (47.0)% | ||||

| Net loss | $ | (18,775) | $ | (21,346) | $ | 2,571 | 12.0% | |

| Net loss attributable to CFI shareholders | $ | (16,819) | $ | (20,307) | $ | 3,488 | 17.2% | |

| Non-controlling interests | $ | (1,956) | $ | (1,039) | $ | (917) | (88.3)% | |

| (Loss) earnings per common share (EPS) – basic | $ | (0.31) | $ | (0.33) | $ | 0.02 | 6.1% | |

| (Loss) earnings per common share (EPS) – diluted | $ | (0.31) | $ | (0.33) | $ | 0.02 | 6.1% | |

| Dividends per share | $ | 0.20 | $ | 0.40 | $ | (0.20) | (50.0)% | |

| Book value per diluted common share(5) | $ | 7.68 | $ | 8.26 | $ | (0.58) | (7.1)% | |

| Excluding significant items(6) | ||||||||

| Total expenses | $ | 766,893 | $ | 564,182 | $ | 202,771 | 35.9% | |

| Income before income taxes | $ | 30,229 | $ | 40,682 | $ | (10,453) | (25.7)% | |

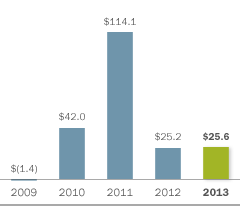

| Net income | $ | 25,644 | $ | 25,193 | $ | 451 | 1.8% | |

| Net income attributable to CFI shareholders | $ | 26,207 | $ | 25,591 | $ | 616 | 2.4% | |

| EPS – basic | $ | 0.16 | $ | 0.28 | $ | (0.12) | (42.9)% | |

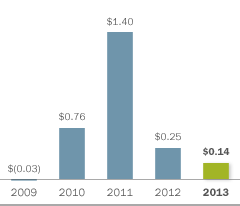

| EPS – diluted | $ | 0.14 | $ | 0.25 | $ | (0.11) | (44.0)% | |

| Balance sheet data | ||||||||

| Total assets | $ | 4,603,502 | $ | 5,762,723 | $ | (1,159,221) | (20.1)% | |

| Total liabilities | 3,538,170 | 4,753,144 | (1,214,974) | (25.6)% | ||||

| Non-controlling interests | 16,169 | 17,454 | (1,285) | (7.4)% | ||||

| Total shareholders’ equity | 1,049,163 | 992,125 | 57,038 | 5.7% | ||||

(1) Data is in accordance with IFRS except for book value per diluted common share, figures excluding significant items and number of employees.

(2) Data includes the results from acquisitions made by Canaccord, and results from these acquisitions are included from the date each

acquisition closed.

(3) Consists of trading costs, premises and equipment, communication and technology, interest, general and administrative, amortization of tangible and intangible assets, and development costs.

(4) Consists of staff restructuring costs and reorganization expenses related to the acquisition of CSHP, as well as restructuring costs related to the reorganization of certain Canadian trading and other operations.

(5) Book value per diluted common share is calculated as total common shareholders’ equity divided by the number of diluted common shares outstanding.

(6) Net income and earnings per common share excluding significant items reflect tax-effected adjustments related to such items. See the Selected Financial Information Excluding Significant Items table on page 32 of the fiscal 2013 MD&A.

n.m.: not meaningful